Anyaberkut

I’ve been reading studies for forty-five years and I’m still learning. The stock market is an undeniable formula or the most complex formula we have created.

It is the most complex system because, not only do we not understand how all the variables interact with each other, we don’t even know what all the variables actually are. We do know, however, that most of the variables are individual sentient beings who can change their behavior according to the information-content in the system, which itself is always changing.

The stock market is a simple system in the sense that there are only two constants: fund-flows and the emotion of fear. These two drivers of the market always move the market in a predictable fashion, although there is often a lag and random noise that comes into play. In the long-run, however, the market always moves according to the fund-flows and according to the herd’s fear response.

In this piece I present the fund-flow part of my most recent weekly summary.

Compared to fiscal-2023, the fund-flows in fiscal-2024 are significantly higher:

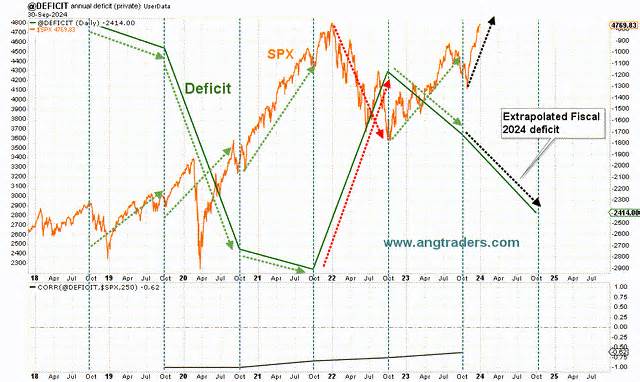

The chart below shows how the SPX has a negative correlation with the federal spending deficit; as the deficit increases (becomes more negative), the SPX becomes more positive (green arrows). And when the deficit decreases (becomes less negative), the SPX decreases (red arrows). The FY2024 deficit is expanding (more negative) from last year (black arrows) and the SPX is reacting higher as expected.

Deficit Spending (ANG Traders, stockcharts. com)

As was the case last year, the SPX has become too extended relative to the net movement rate; The SPX is above the net movement rate of $3 trillion per year (black line below) and we expect it to fall, reaching the rate of $2 trillion per year (green line), as it did last year; The mid-January tax cut can simply be used as a pretext for a rollback. However, the underlying market design remains strongly bullish.

Net-Transfer rates (ANG Traders, stockcharts.com)

Cash Flow Summary (ANG Traders, stockcharts. com)

Bank loans, the other source of liquidity, declined from 2023 to October (start of fiscal year 2024) and have been increasing ever since. It remains to be seen whether it will continue to increase, as the first quarter of the calendar year has a tendency to decrease temporarily. Weakening bank loans: 2023 was uncommon as the decline in loans lasted all year, so perhaps in 2024 bank loans will not weaken in the first quarter of the year.

Aggregate Bank-Credit (ANG Traders, stockcharts.com)

Our liquidity style has been expanding since October (with the exception of a slight dip in the penultimate week).

Liquidity (ANG Traders, stockcharts. com)

The opposite trend of repos reached a low (green box) a few weeks ago and we expect the SPX to reach a low in the next two weeks.

Reverse Repository Style (ANG Traders, stockcharts. com)

Investors have the option to “buy dips” over the next few weeks.

“If you think about it, it’s probably the only report of its kind on the planet. “

“I am VERY grateful for the discovery of this site, as well as the wisdom I have gained. . . “

” I have not seen this type of analysis anywhere else. Please keep up the awesome work! – James “

“Happy ANG subscriber here. I think it’s the market analysts when it comes to alpha research. “

“Here looking for alfa. . . @ANG Traders. The one from!”

Take advantage of our14-day free trial and stay on the right side of the market and Away From the Herd.

This article written by

ANG Traders is an investor with over 40 years of experience and degrees in math, science, and education. He believes that modern financial theory research provides forecasts about market action and that adherence to the main trend is the key to wealth accumulation.