Advertisement

For premium support please call:

When a consumer is in a position to replace their investment strategy, they may be interested in seeing how those potential options will play out in the long term. Portfolio visualization equipment is used to generate models or simulations to compare potential outcomes. The most productive teams are easy to integrate as an advisor and easy for consumers to understand.

Ready to grow your visitor base? SmartAdvisor helps you connect with potential customers.

Portfolio viewers are pieces of equipment that allow advisors to analyze and compare investments in a granular way for their clients. They can be standalone equipment that you can use independently of the software. They can also be incorporated into software features or money plan applications tailored to the needs of advisors. needs.

So what can teams do for you? The features of a portfolio viewer can be extended to:

Comparison of Tactical Assignment Models

Variety and analysis of funds.

Backtesting

Modeling for Portfolio Optimization

Running Monte Carlo Simulations

These types of features are designed to help you provide the most accurate guidance to customers. They also allow them to visualize what their portfolio looks like right now and what it would look like if they did X, Y, or Z with their investments or if they were going through major changes in their lives.

This can be invaluable for consumers who are visually informed and absorb data more easily by viewing it than simply listening to it. Presenting the consumer with charts, graphs, or other visual aids can emphasize the recommendation you offer to make it less difficult to deal with.

Choosing tools to incorporate into your business often comes down to the type of features you’re interested in, the level of functionality you need and the cost you’re comfortable paying. When comparing visualizer tools, it’s helpful to ask yourself the following:

What do I want this tool to do for me (and my clients)?

What are the most important characteristics to have?

What value am I willing to pay in exchange for the diversity of features on offer?

With that in mind, here are six portfolio visualizer options for advisors to consider:

Morningstar Office is an all-in-one practice and portfolio management software program designed for registered investment advisors (RIAs). Its features include:

Portfolio Modeling & Reporting

Portfolio analysis

Investment Planning

Risk Modeling and Risk Profiles

Customer relationship management (CRM) tools

Portfolio Rebalancing

Advisors have access to Morningstar data, research and analysis that can be used to generate style portfolios for clients. If you want to check out the program, you can tap Morningstar to request a demo.

NaviPlan is a financial planning software solution that’s used by banks, insurance providers and broker-dealers. It’s designed to be an end-to-end solution for advisors, spanning everything from new client onboarding to compliance and data security.

The software’s unique features allow advisors to provide monetary recommendations to clients collaboratively and visually. For example, the Guided Retirement tool makes it easy for customers to see if they are on track to retire and how their plans might be impacted through adjustments. in healthcare costs.

NaviPlan is also provided to enable Monte Carlo analysis, situation analysis, and modeling of retirement income sources. Advisors can create charts, graphs, and other visuals from traditional reports tailored to their clients’ needs. A test should be performed if you need to check take out the software before committing.

Nitrogen is designed to be an expansion platform for wealth control firms and advisors who prefer an all-in-one solution. Advisors using Nitrogen are provided with a range of interactive and visualization equipment to help them:

Model the threat capability so that clients perceive the point of threat they want to bring to their targets.

Help clients perceive the effects of life adjustments or monetary decisions, from paying for school to deciding whether to get Social Security benefits.

Running stress tests and model different investment scenarios to gauge outcomes

Nitrogen runs daily analysis for over a quarter million securities, including stocks, exchange-traded funds, mutual funds, bonds and real estate investment trusts. Advisors can tap into the available data to model performance and analyze risk at a detailed level.

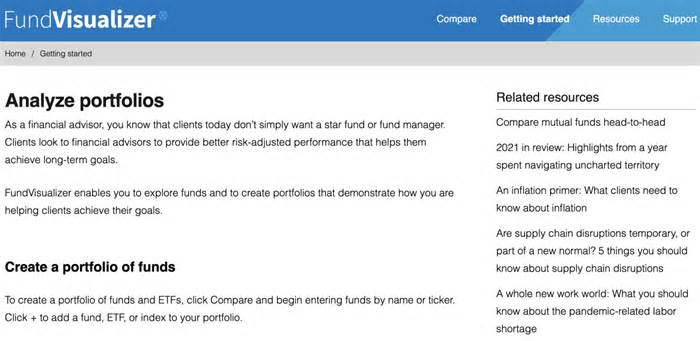

FundVisualizer advisors to compare ETFs, mutual funds, and indices head-to-head or within portfolios. This standalone visualization tool builds on Morningstar’s knowledge so you can compare investments across 80 functionality and threat metrics.

Here are some of the tool’s:

Portfolio modeling and analysis

Interactive charts

Reporting

FundVisualizer makes it easy for you to share your findings with your clients via email and is free for advisors to use. You’ll want to be able to download the tool from the App Store and create an account to get started.

Portfolio Visualizer is another stand-alone option for advisors who want to be able to generate visual models and reports for clients. The Pro subscription plan, which is designed for both personal and commercial use, includes the following:

Portfolio backtesting

Monte Carlo Simulations

Portfolio Optimization

Factorial regression

Asset analytics

Tactical Assignment Models

You can check out the pattern portfolio visualizations on the site or sign up for a demo to check out the tool for yourself and if it’s right for you.

eMoney Advisor is a comprehensive money planning software that aims to equip advisors with everything they need to manage consumer portfolios. This includes interactive and visual tools.

For example, the Decision Center allows to you analyze investments and their lifetime impact on client portfolios. You can also run a Money Carlo analysis and create personalized plan summaries for clients.

There are 4 bundle features available: eMoney Plus, eMoney Pro, eMoney Premier, and eMoney Enterprise. They all come with built-in education and to make the transition to e-money as undeniable as possible.

The portfolio visualization team can make your task as an advisor less difficult if you can demonstrate to clients what they can expect by opting for one investment over another. Understanding which features are most likely to appeal to your consumers can help you determine which tool(s) is maximally productive for your business.

Investors are increasingly turning to online searches to connect with money professionals. Having an online page and being active on social media can make it easier for you to get noticed, but if you need to generate faster results, you may need to add an online lead generation tool. With SmartAdvisor, for example, you can connect with customers without having to spend hours out of your busy day calling or emailing.

Software tools can help you save time, allowing you to run your advisory business more efficiently. In addition to comparing visualizer tools, you might also consider whether your current financial planning, wealth management or estate planning software is working for you. Researching different options to compare features, benefits and costs can help you evaluate if what you’re using now is still meeting your needs and those of your clients.

Photo credit: ©iStock/Kerkez, iStock/Morningstar Office, iStock/NaviPlan, iStock/Nitrogen, iStock/FundVisualizer, iStock/Portfolio Visualizer, iStock/eMoney Advisor, ©©©©©©iStock/Jacob Wackerhausen

The article Portfolio Viewer Options for Financial Advisors appeared first on SmartAsset SmartReads.

Advertisement

Advertisement

Advertisement

Advertising

Advertising

Advertising

Advertising

Advertising

Advertising

Advertising

Advertising