A handful of companies dubbed Germany’s answer to America’s “Magnificent Seven” have sparked a rally in the country’s stock market this year, defying the pessimism engulfing the country’s economy.

Frankfurt’s Dax, an index of 40 blue-chips, has risen 18.7 per cent this year, beating the benchmarks in France and the UK, and far outstripping the region-wide Stoxx Europe 600 index’s 4.8 per cent gain.

The functionality comes despite weak domestic expansion and political unrest, with Germany’s unpopular coalition government collapsing in November after parties failed to reach agreement on reforms. of a fiscal “debt brake,” and the country is now heading toward early elections in February.

At the same time, the economy is expected to grow just 0. 6 in 2025, down from 1. 2 expected mid-year, according to economists surveyed through Consensus Economics. This is the biggest relief in the projected expansion in an era of any primary trading economy.

The functionality of the Dax “was a surprise,” said Timothy Lewis, a portfolio manager at JPMorgan Asset Management, and “is a great example of the saying that the stock market and economic functionality are the same thing. “

Dax citizens earn less than a quarter of their income in Germany, which has helped cushion the shocks that, for example, caused auto giant Volkswagen to announce plans to lay off tens of thousands of employees and close. several factories.

Some could not be charged. Check your internet connection or browser settings.

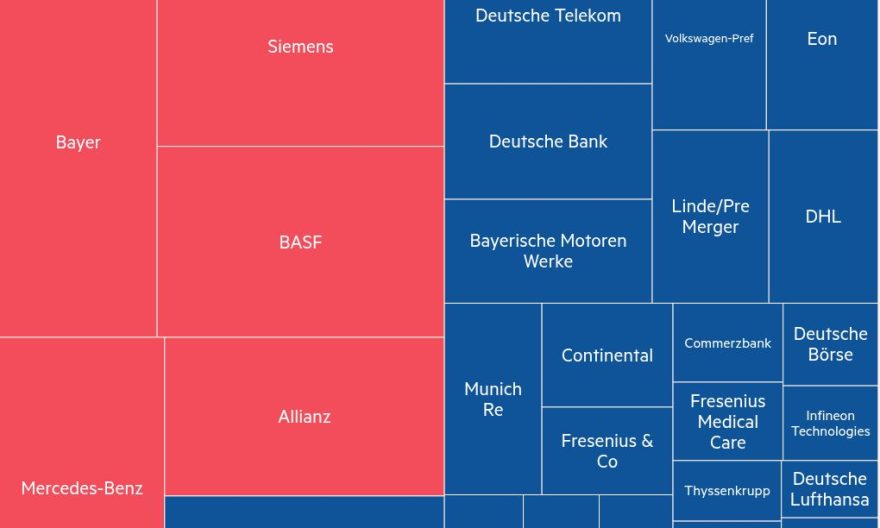

This year’s bumper stock market returns have largely been driven by seven companies: software giant SAP, defence stock Rheinmetall, industrial conglomerate Siemens, Siemens Energy, Deutsche Telekom, and insurers Allianz and Munich Re.

SAP accounts for about 40% of Dax’s earnings, and its shares are up more than 70% as its enterprise consumers transition to the cloud. It accounts for a larger share of the index than the auto sector, adding Volkswagen and Mercedes-Benz. in the red this year.

SAP has benefited this year from the market’s huge appetite for stocks exposed to synthetic intelligence. To this end, the company has moved its results calendars from European mornings to after the US market closes, to give it more visibility to North American investors and analysts. In October, it replaced Dutch semiconductor device maker ASML as Europe’s largest generation company.

“Tech stocks have been the story of this year and, unfortunately, in Europe we have two major players: ASML and SAP,” said Marc Halperin, co-head of European equities at asset manager Edmond de Rothschild. “The icing on the cake is AI. “

All seven profit-generating companies on the Dax benefited from tailwinds, with defense company Rheinmetall soaring 107 percent this year on rising expectations for higher defense spending in Europe, while Siemens Energy gained a 329 percent due to growing demand for renewable energy.

Some content could not load. Check your internet connection or browser settings.

Guillaume Jaisson, a macro strategist at Goldman Sachs, said the market was telling “two other stories,” and that market leaders — which he compared to Wall Street’s seven superb tech stocks — were outperforming some exporters vulnerable to weakness from Chinese clients and imaginable U. S. tariffs.

A weaker euro has also boosted the export-focused German market, which has fallen from 1. 11 euros to 1. 04 euros since the end of September.

Some investors and analysts are concerned about the benchmark’s growing dependence on a small number of stocks.

“It risks an unstable market,” said Arne Rautenberg, a portfolio manager at Union Investment, who believes the market is vulnerable to an earnings shock from SAP.

The election of a new government and potential changes to Germany’s debt brake, US president-elect Donald Trump’s plans for trade tariffs, or China’s stimulus for its domestic economy could “change things very quickly” for the market, he added.

Halperin added that he had recently moved to a position on SAP that was smaller than the benchmark as earnings expectations started to climb to the lofty heights of US peers.

The narrowness of the Dax rally has increased in recent years, and the trend has gained strength after the pandemic and reflects the situation in the United States, where there are fears about the role of a few giant generation corporations in generating AI returns . order.

Some could not be loaded. Check your internet connection or browser settings.

Chipmaker giant Nvidia, for example, accounts for about a quarter of gains in the benchmark S-index.

But many fund managers remain optimistic that German stock clients trade at deep discounts to their U. S. peers and make a significant portion of their profits outside their home market.

Marc Schartz, a portfolio manager at Janus Henderson, said the Dax’s concentration was “pretty extreme” but spread across energy, telecoms and insurance, unlike the US, which is solely concentrated in technology stocks. “Having a more diverse set of companies driving the markets isn’t a bad thing,” he said.

“The companies we invest in are all pan-European. It’s just a coincidence that they are indexed in a certain zip code,” Schartz added.

Additional information via Ray Douglas in London