Recently, rumors have circulated that Bitcoin is being “liberated” in China, from unsourced tweets to incorrect reports about the Chinese Communist Party’s plans for Bitcoin. Since Hong Kong legalized a Bitcoin spot ETF, those rumors have multiplied. To understand those rumors, you will have to understand the existing legal status of Bitcoin in China and what the Bitcoin bans mean, a topic I studied in depth in my e-book on Bitcoin and China.

First of all, we want to perceive what is happening in China right now. After the Hong Kong protests, the lines between the “One country, two formulas” dynamic that promised Hong Kong a form of government different from that of the mainland narrowed. However, when it comes to Bitcoin and cryptocurrencies, Hong Kong has another formula and regulators. This has allowed Hong Kong to remain legal to trade Bitcoin, and new regulations limit drive-thru counters, physical coin outlets where you can display coins and get Tether or Bitcoin, or the other way around; For now, they operate under an exemption. for peer-to-peer replacements. Hong Kong’s constitution, the Basic Law, enshrines some protections for Bitcoin trading. Therefore, it is unlikely that Hong Kong will ever ban Bitcoin trading like mainland China has done, until there is an update to the Basic Law.

Hong Kong Spot Bitcoin ETFs are attractive because they involve three major mainland Chinese asset managers through their Hong Kong subsidiaries (ChinaAMC, Harvest and Bosera. However, for now, investors from China are prohibited from mainland investors to invest in Hong Kong Bitcoin spot and futures ETFs. Issuers have rarely cited “offshore” mainland interests.

This is because Bitcoin is tightly regulated in Mainland China. People have been arrested for trading Tether by itself and using virtual currencies (in conjunction with other crimes). Bitcoin mining is banned, with Bitcoin mining conferences moving out of Mainland China and significant amounts of hashing/mining power. Bitcoin exchanges no longer serve Yuan trade for cryptocurrencies, and they generally ban Chinese IP addresses from accessing their services – and many overseas exchanges have their IP addresses blocked by the Great Firewall.

The Bitcoin bans in China really are a set of regulatory notices that escalate year by year, involving law enforcement in 2021. At the same time, Chinese courts have generally held that Bitcoin is property protected by the law (and likely will continue to do so—leading to more headlines that China is reconsidering Bitcoin each time).

There have been some notable headlines regarding China, such as the Hong Kong professor who thought banning Bitcoin mining was a mistake because it increased tax revenue for the United States. It’s entirely possible that China will study Bitcoin as it did with “blockchain” and Web3—and that headlines will continue in this direction, especially with the potential of a pro-Bitcoin Trump administration.

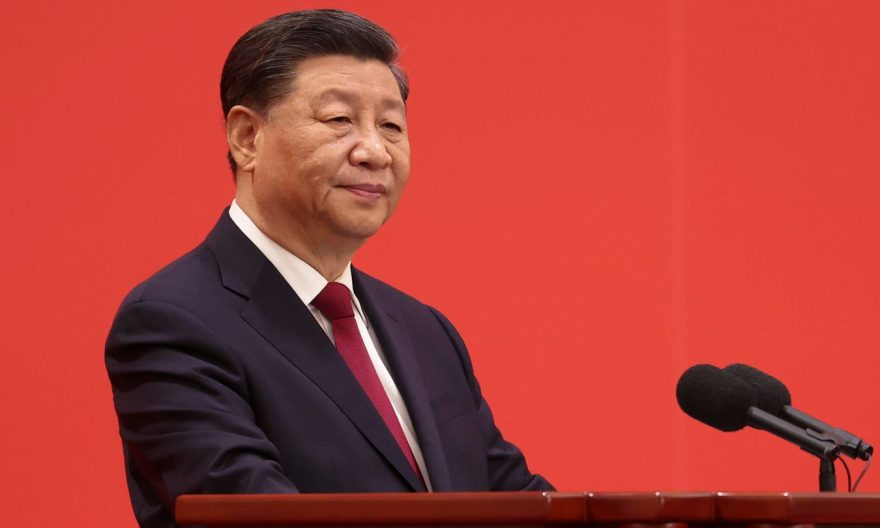

Very unlikely. Most of the technical agencies behind the Bitcoin bans/regulations, such as the People’s Bank of China and SAFE, which administers capital controls, follow decades-long paths to policy. While it’s true that in the past, words from Xi Jinping have led to acceleration and changes to policy paths, the mining bans were handed out by Liu He, one of Xi Jinping’s most trusted economic advisors. With Xi Jinping likely holding power until at least 2029, it would take a dramatic about-face from him to change entrenched policy paths – without considering the deep ideological fight against Bitcoin within the Chinese Communist Party.

China was one of the first countries to recognize the risk that Bitcoin poses to its model, from strict capital controls to power control. China’s progress regarding the virtual Yuan is not so unexpected considering that the greatest tension in Chinese politics lies in the degree of control that the Party exercises over the economy. The policy of spreading central bank virtual currencies and replacing Bitcoin is unlikely to be opposite, meaning China’s headlines are unlikely to involve policy adjustments; would possibly support value sentiment as headlines reflect China’s continued acceptance of Bitcoin as property, Hong Kong reports. with the Bitcoin Spot ETF and close scrutiny through the US President, regardless of which party he belongs to – a date of absolute and long-term precedence of the Chinese party-state.

One Community. Many Voices. Create a free account to share your thoughts.

Our community is about connecting people through open and thoughtful conversations. We want our readers to share their views and exchange ideas and facts in a safe space.

To do so, please comply with the posting regulations in our site’s terms of use. Below we summarize some of those key regulations. In short, civilians.

Your message will be rejected if we realize that it seems to contain:

User accounts will be locked if we become aware that users are engaging in:

So, how can you be a power user?

Thanks for reading our community guidelines. Please read the full list of posting rules found in our site’s Terms of Service.