Tesla has now revealed that it is spending cash to announce its shareholders’ vote in favor of Elon Musk’s $55 billion payment package.

In 2018, Tesla shareholders approved one of the largest payment plans of all time: a $55 billion CEO payment plan based exclusively on stock for Elon Musk.

In January, a ruling ruled in favor of lawyers representing a Tesla shareholder, alleging that Tesla’s board of directors misrepresented the pay package when it presented it to shareholders.

It’s a complex issue, but in short, the ruling found that Tesla and Musk’s board of directors had failed to comply with a public company’s regulations when they presented the plan to shareholders.

The judgment found that Tesla had governance issues in drawing up the payment plan and that those issues were not communicated to shareholders before voting on the plan.

Instead, Tesla claimed that the plan was negotiated through “independent board members” when it discovered that some board administrators had, among other things, private financial relationships with Musk outside of Tesla.

The Delaware court ruled that this invalidated the vote and Tesla had to cancel the payment plan.

Last month, Tesla told shareholders it would ask them to vote on moving Tesla’s incorporation status to Texas, and then they would vote in favor of Musk’s payment plan converting anything.

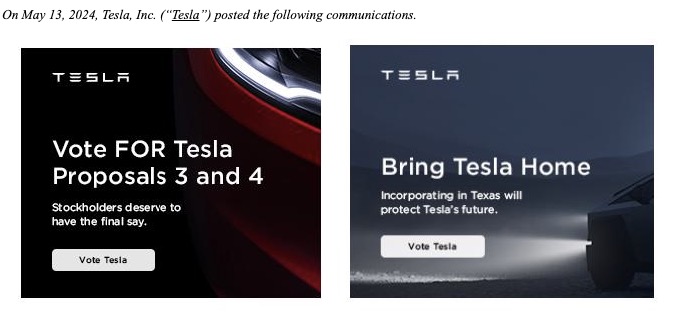

Since then, Tesla has worked hard to get shareholders to vote in favor of any of those points. It has introduced an advertisement to advertise it, sent countless communications to shareholders about it, and now the company’s board of directors is going even further.

In a new SEC filing, Tesla showed that it is now buying ads to inspire shareholders to vote for those items:

Tesla will have to register with the SEC any “communications” it has with shareholders in connection with the vote and this time the communications are indexed as “sponsored” on Google, meaning Tesla bought classified ads from Google for it.

The automaker even spent cash in Elon Musk’s wallet by buying classified ads in X with the message indexed as “promoted. “

They laid off many workers due to tariff issues while also incurring higher trading prices to convince shareholders to dilute their share price. Just to summarize.

Tesla shareholders have until June 13 to vote in favor of their shares.

Tesla’s board of directors is obviously getting nervous about the vote.

It’s quite curious that Tesla’s board of directors, which invalidated Elon’s payment package after a ruling over uncovered governance issues, is now approving spending Tesla’s cash on an Elon-owned platform in an attempt to influence a vote that would send even more cash into Elon’s pockets.

That’s how we are now.

Fred is Editor-in-Chief and Senior Editor at Electrek.

You can send via Twitter (DMs open) or by email: fred@9to5mac. com

With Zalkon. com, you can view Fred’s portfolio and get monthly green stock investment concepts.