The risk disclosure statement found in the latest annual report and company guidance about DCF don’t match. Expect a cash shortfall this year.

USAC have diluted unitholders severely for the past 4 years with unit count increasing by 264%.

USAC’s heavy debt load doesn’t give management room to maneuver.

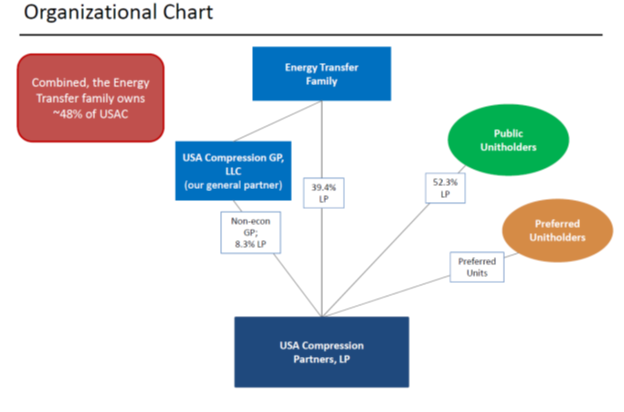

The macro environment surrounding USA Compression Partners (USAC) is favorable to the growth of the company in the long term. With the acquisition of CDM Resource Management, the business doubled in size, positioning themselves as an important player in the compression services industry.

However, the nature of the business acquisition and how the company accounts for such transaction can provide challenges to investors willing to analyze the latest annual report. I found disclosures in company filings that merit more in-depth due diligence to potential investors, which include future dilution, a reduction of debt leverage as stated on financial covenants and not sufficient cash available for distributions.

For these reasons, investors should be cautious about a potential investment in USAC. High expectations about growth and failure to accomplished them is a dangerous combination.

Business overview

USA Compression Partners is one of the largest independent providers of compression services. Compression is needed to aid the transportation of natural gas through pipelines systems and in some cases enhancing crude oil production through artificial lifting, allowing oil to flow at a higher rate.

USAC business operations focuses on areas where there is natural and crude oil production growth. In the U.S these areas are the shale plays in the Utica, Marcellus, Permian Basin, Eagle Ford, Mississippi Lime, Granite Wash, Woodford, Barnett, Haynesville, Niobrara and Fayetteville shales. Organic growth would come from the expected increase in production and transportation volumes as well as the need for more compressing power required in the shale plays in comparison to conventional basins.

Customer retention has proven to be sticky given high switching costs, providing something of a soft barrier to entry assuming high service standards are maintained, which appears to be the principal differentiator among competitors. – Moody’s Press release

(Emphasis added by author)

Our marketing and client service functions are performed on a coordinated basis by our sales team and field technicians. Salespeople, applications engineers and field technicians qualify, analyze and scope new compression applications as well as regularly visit our customers to ensure customer satisfaction, determine a customer’s needs related to existing services being provided and determine the customer’s future compression service requirements. This ongoing communication allows us to quickly identify and respond to our customers’ compression requirements. – 2018 Annual report

(Emphasis added by author)

Most of their compression units are utilized by centralized natural gas gathering systems.

On July 30, 2019, 6,397,965 Class B Units automatically converted into common units on a one-for-one basis, resulting in the issuance of 6,397,965 common units to ETO. Following the conversion, there are no longer any Class B Units in the Partnership outstanding.- 2Q 2019 10Q

On November 13, 2018, the Partnership filed a Registration Statement on Form S-3 to register 41,202,553 common units that are potentially issuable upon conversion of the Preferred Units and exercise of the Warrants. – Annual report

(Emphasis added by author)

The second event relates to the General Partner purchase agreement, in which ETE acquired all interests in the General Partner and approximately 12.5M USAC common units in exchange of $250M. As part of the transaction ETE agreed to cancel all IDRs, eliminating any economic interests for 8M newly issued common units:

In early April, we closed on the previously announced series of transactions by which USA Compression acquired CDM Resource Management from Energy Transfer, and at the same time, Energy Transfer equity acquired control of our general partner while also eliminating the economic GP interest and IDR.- Q1 2018 Conference call

CDM is deemed to be the accounting acquirer of the Partnership in the business combination because its ultimate parent company obtained control of the Partnership through its acquisition of the limited liability company interests in the General Partner. Consequently, CDM is the predecessor of the Partnership for financial reporting purposes and the historical consolidated financial statements of the Partnership relating to periods prior to the Transactions Date, but filed subsequently reflect those of CDM, as the accounting acquirer. CDM’s assets and liabilities retained their historical carrying values – 2018 Annual Report

(Emphasis added by author)

Therefore, going through the latest annual report can create some confusion with USAC investors. Results become difficult to compare.

As an example, let’s look at the last annual report and 2017’s annual report and how it is difficult to make YoY comparisons.

The Partnership’s historical assets accounted for $252.1 million of contract operations revenue for the year ended December 31, 2018.”- 2018 10K

Organically, revenues at USAC declined YoY about 12.2M or 4.6% from 2017 to 2018, which in itself doesn’t raise any red flags as it could be attributed to normal course operations.

I believe comparisons will become much easier once the 2019 annual report becomes available as we will be able to compare results on an apple to apples basis, as there will be two complete years since the acquisition was made.

There was one issue I did find that caused some concern. Because of the accounting treatment in the acquisition of CDM, the 2018 10K was missing an important disclosure found on the 2017 10K. That disclosure is important to equity investors as it relates to equity offerings.

The below Equity Offering disclosure in the Liquidity and Capital Resource section was missing from the 2018 10K, which is found on the 2017 10K and states the following:

Full-Year 2019 Outlook

USA Compression is updating its full-year 2019 guidance as follows: