UnitedHealth is a clear leader in its industry and profits from meaningful scale advantages.

The company has delivered outstanding growth in the past; its growth outlook is positive as well.

Shares are not trading at a high valuation, and even under conservative assumptions, total returns should be attractive.

Thesis

UnitedHealth Group (UNH) has delivered outstanding growth in the past and sports excellent fundamentals. The growth outlook for the healthcare/insurance company is strong as well, and investors can count on further meaningful earnings per share and dividend growth over the coming years. Its valuation is not overly high, and thanks to the stock’s weakness over the last couple of months shares of UnitedHealth Group can be bought at one of the lowest valuations compared to how the stock traded over the last couple of years. The combination of these factors makes UnitedHealth Group look attractive at current prices, at least for investors that are focused on capital appreciation instead of dividend income.

Company Overview, Growth History, And Fundamentals

UnitedHealth Group is a diversified health & insurance company that offers a variety of different services to its customers. It is split into the divisions UnitedHealthcare, OptumHealth, OptumInsight, and OptumRx. Through these business units, UnitedHealth Group provides services to individuals, employers, small businesses, and corporations, including health benefit plans, health & well-being services, etc. On top of that UnitedHealth Group also offers software products and consultation to professionals and businesses from the healthcare industry. Last but not least, UnitedHealth Group also offers a range of pharmacy services to its customers. Through being active in many different sub-sectors of the large healthcare industry, UnitedHealth has managed to grow into one of the largest companies in the US, currently trading with a market capitalization of more than $200 billion.

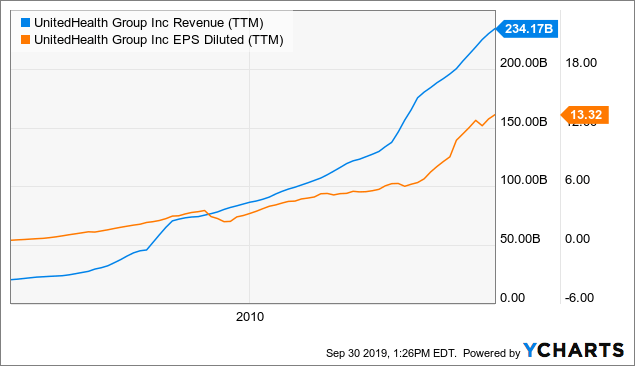

UnitedHealth has both an excellent growth track record, as well as great fundamentals:

The Power of Multiple Cash Flow Streams

Jonathan Weber is now covering the large-cap dividend sector for Cash Flow Kingdom: “The Place where Cash Flow is King”.

From inception (1/1/2016) through January 2019, the CFK Income Portfolio has had a total return* of 50.2% (verse 46.8% for the S&P 500, and 32.3% for the Russell 2000). This was accomplished while offering a very attractive average portfolio yield (currently 9.6%), an income stream that looks like this:

Cash Flow Kingdom, “The Place where Cash Flow is King”

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.