We have the purchasing managers’ indices for the U.S. and the news is good.

The economy as a whole is not in recession nor even near it. Manufacturing could be said to be near technical recession.

This is partly trade war issues, but the importance is that manufacturing is a small part of the economy.

Our Basic Economic Worry

We want to know when the next recession is coming. There will be one and it’s actually, even in theory, impossible to predict when. But we can get an idea, if not proof, by looking at what is actually happening out there. The reason we’re interested is because a recession will change Federal Reserve policy, possibly even fiscal policy from the government. Changed policy makes a difference to our investments of course.

The Twin Parts Of The Economy

We have as an historical hangover this idea that manufacturing is a terribly important part of the economy. It isn’t. It used to be 40 to 50% of all economic activity and thus was important. Now it’s perhaps 10% – in common with all rich countries other than Germany and Switzerland – and that’s interesting but not important.

Still, history matters even with ideas. The one thing that does make manufacturing important for our use here is that it varies more over the business cycle than services do. We can thus think of it as the canary in that economic coal mine.

We need to be careful, though. If manufacturing is slowing for reasons we can actually see and note, then that might well not be the start of a recession – it’s too small to cause one. It’s if we can’t work out why, if it seems to be just a cyclical turn, then that it can be an indicator.

Manufacturing PMI

For the US, this comes from the Institute of Supply Management. We had the flash PMI a few days back, the real out-turn figures are worse than we thought:

“According to the IHS Markit’s Flash US PMI report, the Manufacturing PMI dropped below the 50 mark for the first time in nearly 10 years at 49.9 and missed the market expectation of 50.5.”

The actual numbers:

“The August PMI registered 49.1 percent, a decrease of 2.1 percentage points from the July reading of 51.2 percent.”

Don’t forget, a PMI is deliberately set up so that a reading of less than 50 is contraction. So, manufacturing is contracting in the US.

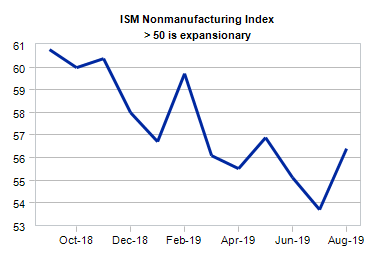

“The NMI registered 56.4 percent, which is 2.7 percentage points higher than the July reading of 53.7 percent. This represents continued growth in the non-manufacturing sector, at a faster rate.”

Well, no, we don’t see any sign of that, do we? Services are growing and growing faster than before. Further, services are some 80% of this modern economy of ours. So, as a whole, the economy is firmly in growth territory.

“Even if the ISM index stays below 50 for the next several months, as long as the index does not decline much further, the manufacturing sector will not be what drags the economy into a recession. Manufacturing is not the U.S. economy; it accounts for only 10% of GDP and 9% of employment.The larger implications of continued contraction in manufacturing may be for monetary policy. The Federal Reserve has been paying more attention to manufacturing because of the headwinds from a slowing global economy and U.S. trade policy. Even so, the ISM’s August print does not significantly alter our slam-dunk odds of a rate cut in September.”