VNQI invests in real estate companies outside of the U.S.

The fund’s high exposure to China and Japan is disadvantageous as these two countries will face population declines in the next few decades.

A rebound to VNQI’s fund price is likely due to favorable monetary policies by various central banks around the world.

Therefore, investors should use this opportunity to rotate capital to other funds.

ETF Overview

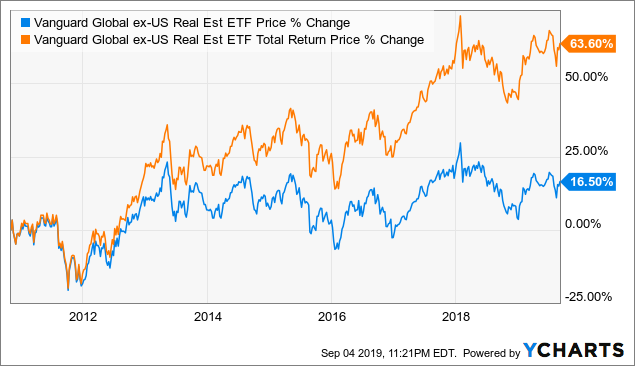

Vanguard Global ex-U.S. Real Estate ETF (VNQI) has a portfolio of real estate stocks internationally but excludes U.S. stocks. The ETF is a good vehicle for investors seeking exposure in the real estate markets outside of the U.S. However, it has a high exposure to Japan and China where these two countries’ populations will continue to face structural declines in the coming decades. Fortunately, we expect VNQI’s share price to rebound in the near term due to favorable monetary policies by various central banks around the world. Therefore, we think investors should take advantage of the rebound and move money off the table.